Condo Insurance in and around Philadelphia

Get your Philadelphia condo insured right here!

Insure your condo with State Farm today

- 19122

- 19104

- 19085

- 19131

- 19141

- 08028

- 19146

- 19147

- 19148

- 19145

- 19153

- 19023

- 19142

- 19038

Your Search For Condo Insurance Ends With State Farm

As with anything in life, it is a good idea to expect the unexpected and attempt to prepare accordingly. When owning a condo, the unexpected could look like damage to your most personal possessions from smoke theft, weight of sleet, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Get your Philadelphia condo insured right here!

Insure your condo with State Farm today

Why Condo Owners In Philadelphia Choose State Farm

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance covers more than your condo. It protects both your condo and your precious belongings. In the event of a burglary or a tornado, you could have damage to the items inside your condo on top of damage to the townhouse itself. Without adequate coverage, you might not be able to replace your valuables. Some of your belongings can be insured against damage or theft even beyond the walls of your condo. If your bicycle is stolen from work, a condo insurance policy might come in very handy.

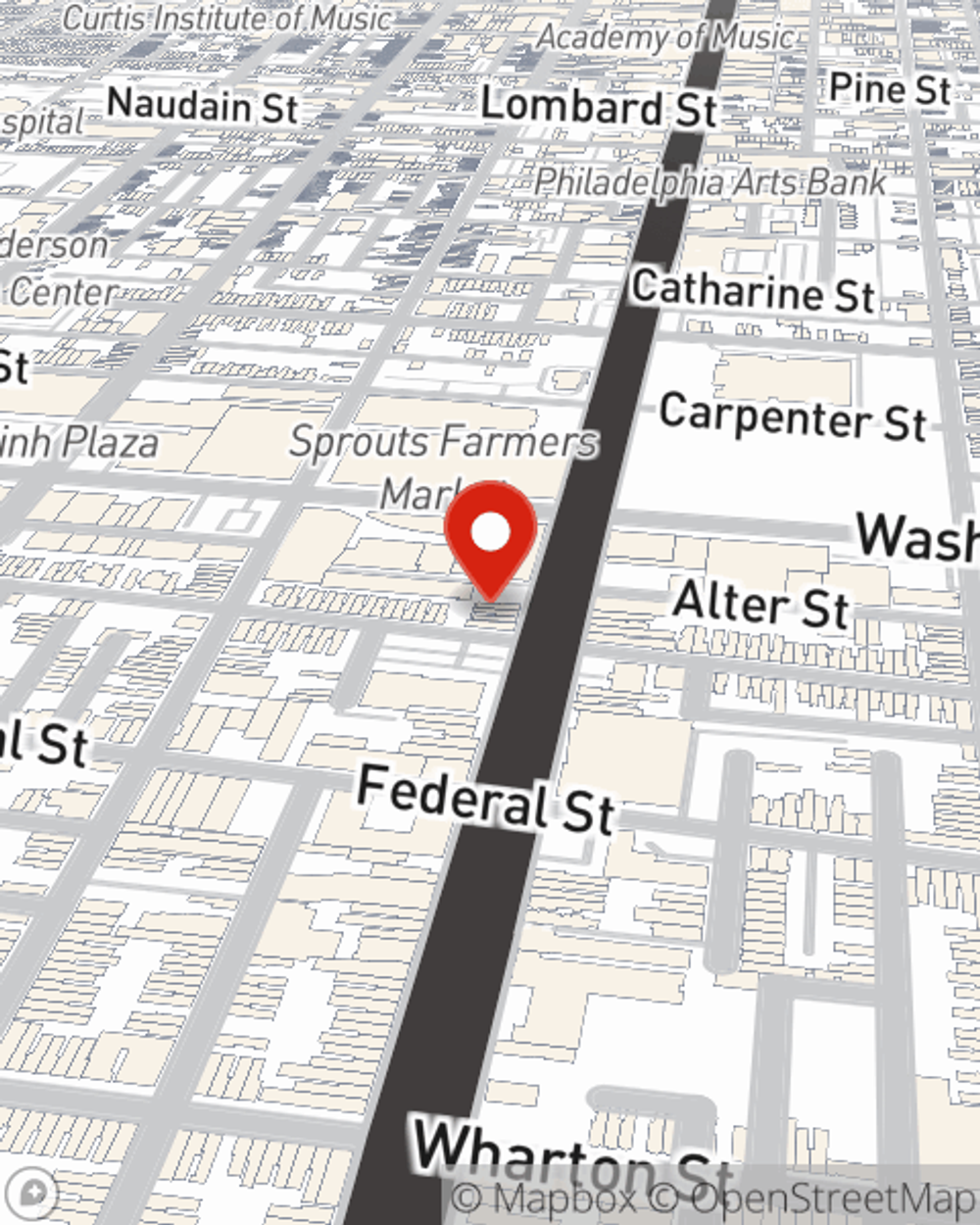

Fantastic coverage like this is why Philadelphia condo unitowners choose State Farm insurance. State Farm Agent Erica Bantom Martin can help offer options for the level of coverage you have in mind. If troubles like identity theft, drain backups or wind and hail damage find you, Agent Erica Bantom Martin can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Erica at (215) 875-8100 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Erica Bantom Martin

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.