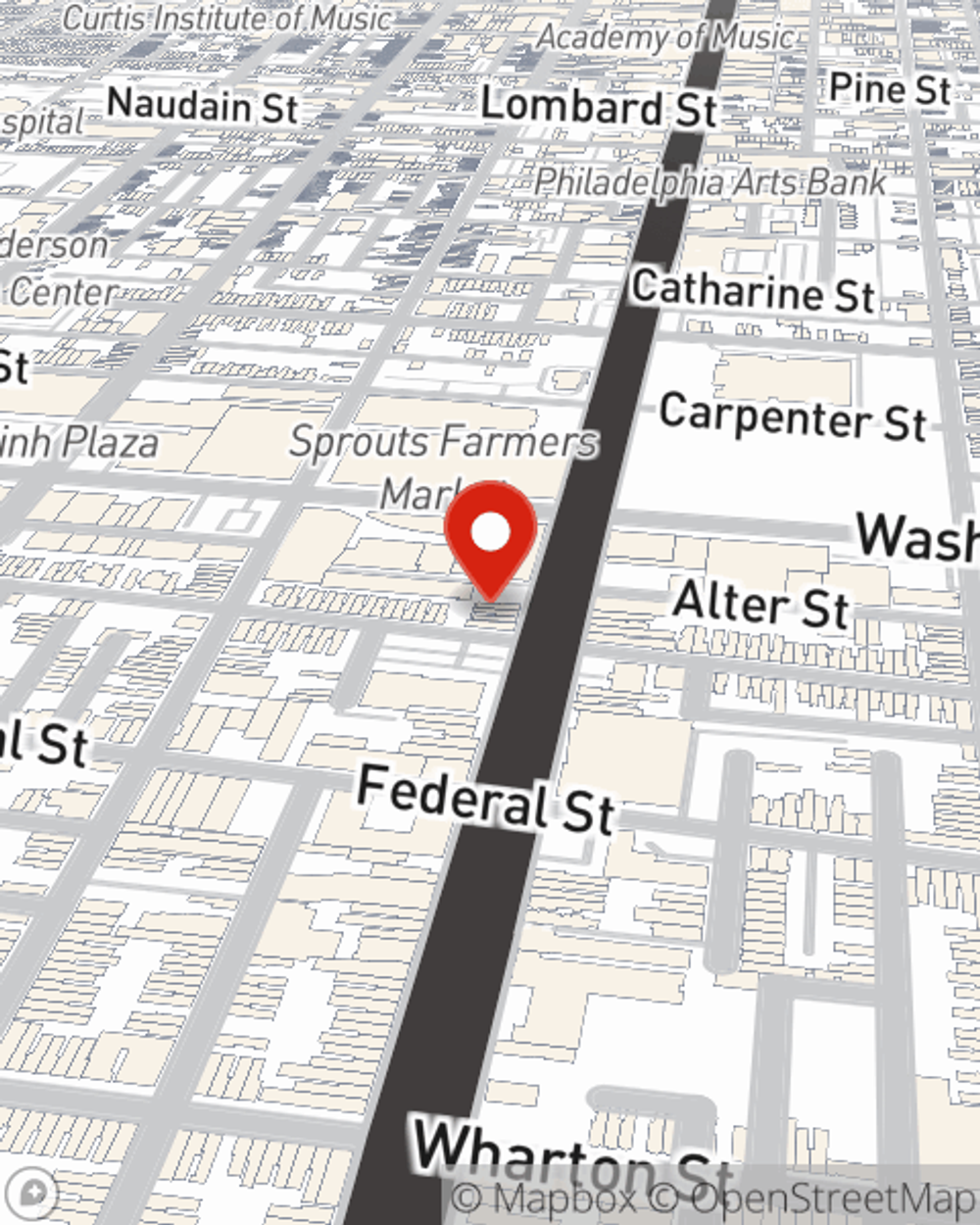

Life Insurance in and around Philadelphia

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- 19122

- 19104

- 19085

- 19131

- 19141

- 08028

- 19146

- 19147

- 19148

- 19145

- 19153

- 19023

- 19142

- 19038

Your Life Insurance Search Is Over

Think you are too young for life insurance? Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Philadelphia, PA, friends and neighbors both young and old already have State Farm life insurance!

Get insured for what matters to you

Don't delay your search for Life insurance

Agent Erica Bantom Martin, At Your Service

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in terrific costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Erica Bantom Martin or one of their knowledgeable representatives. Erica Bantom Martin can help design coverage options for the level of coverage you have in mind.

Did you know that there's now a life insurance option available that's perfect for anyone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be of good use when it comes to paying for final expenses like medical bills or funeral costs. Don't let these expenses burden your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Erica Bantom Martin for help with all your life insurance needs

Have More Questions About Life Insurance?

Call Erica at (215) 875-8100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Erica Bantom Martin

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.